Opportunity Zones

def.: an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment.

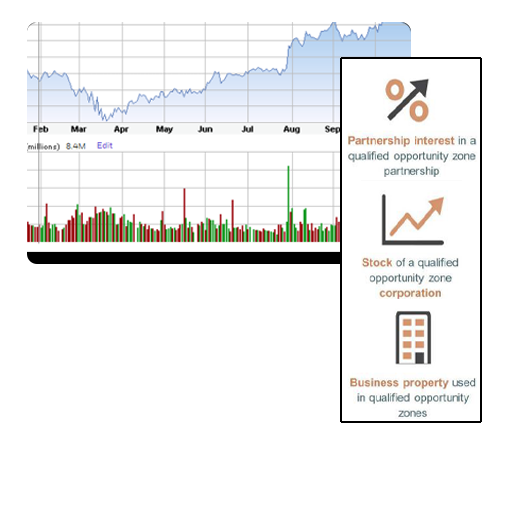

QUALIFIED OPPORTUNITY ZONE FUNDS

A QOF is an investment vehicle that files either a partnership or corporate federal income tax return and is organized for the purpose of investing in QOZ property.

BUSINESS & REAL ESTATE INVESTMENTS IN OPPORTUNITY ZONES

Qualitifed Opportunity Zone (QOZ) investment is not limited to real estate transactions. Businesses that operate within an QOZ can qualify for tax benefits as well. In some cases, QOZ businesses are in a better position to capitalizing on QOZ benefits than real estate invesments.

WHAT DOES IT MEAN IF I'M ALREADY IN AN OPPORTUNITY ZONE?

If your business is already in a Qualified Opportunity Zone (QOZ), you can still capitalize on the designation but it adds a level of complication and would require some restructuring of your business ownership. Please contact us to learn what options you have to qualify for QOZ beneift.

Opportunity Zones Background

A qualified opportunity zone (QOZ) is an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities qualify as QOZs if they have been nominated for that designation by a state, the District of Columbia, or a U.S. territory and that nomination has been certified by the Secretary of the U.S. Treasury via his delegation of authority to the Internal Revenue Service (IRS). QOZs were added to the tax code by the Tax Cuts and Jobs Act on December 22, 2017.

QOZs are an economic development tool that are designed to spur economic development and job creation in distressed communities. They are designed to spur economic development by providing tax incentives for investors who invest new capital in businesses operating in one or more QOZs.

- First, an investor can defer tax on any prior eligible gain to the extent that a corresponding amount is timely invested in a Qualified Opportunity Fund (QOF). The deferral lasts until the earlier of the date on which the investment in the QOF is sold or exchanged, or December 31, 2026. If the QOF investment is held for at least 5 years, there is a 10% exclusion of the deferred gain. If held for at least 7 years, the 10% exclusion becomes 15%. Additionally, the amount of eligible gain to include is decreased to the extent that the amount of eligible gain you deferred exceeds the fair market value of the investment in the QOF.

- Second, if the investor holds the investment in the QOF for at least 10 years, the investor is eligible for an adjustment in the basis of the QOF investment to its fair market value on the date that the QOF investment is sold or exchanged. As a result of this basis adjustment, the appreciation in the QOF investment is never taxed. A similar rule applies to exclude the QOF investor’s share of gain and loss from sales of QOF assets.

Link to IRS’ QOZ FAQ: https://www.irs.gov/credits-deductions/opportunity-zones-frequently-asked-questions#general

Link to Colorado QOZs: https://choosecolorado.com/programs-initiatives/opportunity-zones/

LEARN MORE ABOUT OPPORTUNITY ZONES

Contact us to learn more about qualified opportunity zones and 1031 exchanges.